Unit Economics

4 Key Metrics You Need to Know Before Running Paid Ads

Contact Us Today

Home » Unit economics

-

Vitaliy

- Last Updated: May 23, 2024

What is Unit Economics?

Unit economics refers to the direct revenues and costs associated with a particular business model, expressed on a per-unit basis. For e-commerce businesses, a “unit” typically refers to a single customer, order, or product. Analyzing unit economics helps businesses understand their profitability by focusing on the value and cost of each unit.

Why Is It Important to Do Your Unit Economics?

Doing your unit economics ensures your business is financially healthy and you spend your ad dollars profitably.

Here is a more detailed breakdown of why it matters:

- Profitability: It shows whether you are making money with each sale after accounting for costs.

- Cost Control: It helps identify where to reduce expenses without harming your business.

- Pricing Strategies: It guides you in setting prices that maximize profits.

- Marketing Efficiency: Knowing how much it costs to acquire a new customer and how much value that customer brings over time helps you spend your marketing budget wisely.

- Growth Forecasting: allows you to predict future profits and plan for sustainable growth.

For example: you run a Facebook Ads campaign and acquire your first client after $50 spent. Have you made any profits at a $50 CPA? Well, if your average order value is $50 or less, you will most likely lose money because your marketing costs exceed your average revenue. If your average order value is $200 or greater, you have made some profits. This is just a basic example; in reality, things can get quite nuanced – and we will get to it later in the article, so keep on reading.

Unit Economics for E-Commerce

For e-commerce, the key metrics in unit economics are AOV, LTV, CPA, and CAC. Using this set of metrics, businesses can make informed decisions to enhance their profitability and drive sustainable growth. Mastering these will give you the insights to make informed decisions and optimize your e-commerce strategy.

Average Order Value (AOV)

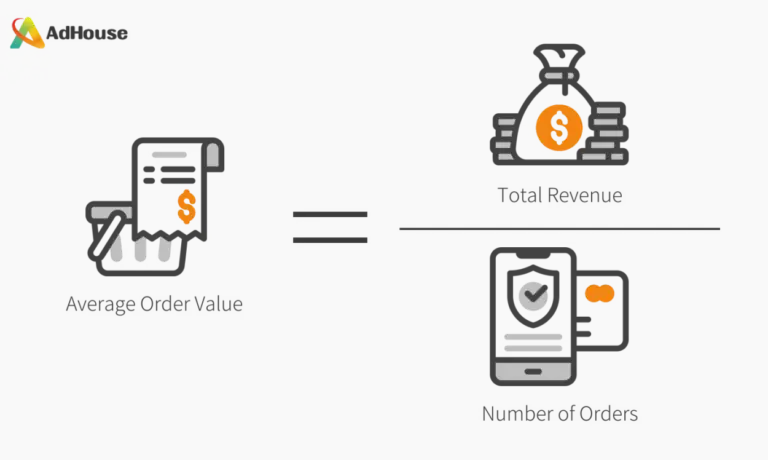

What is Average Order Value (AOV)?

Average Order Value (AOV) represents the average amount customers spend per order.

Why is it important to know your Average Order Value (AOV)?

AOV provides insights into your customers’ purchasing behaviors. By increasing your AOV, you can enhance your revenue without needing to grow your customer base.

AOV Formula:

AOV Calculation Example:

If your monthly revenue is $10,000 from 200 orders, your AOV is $50 ($10,000/200=$50).

Lifetime Value (LTV)

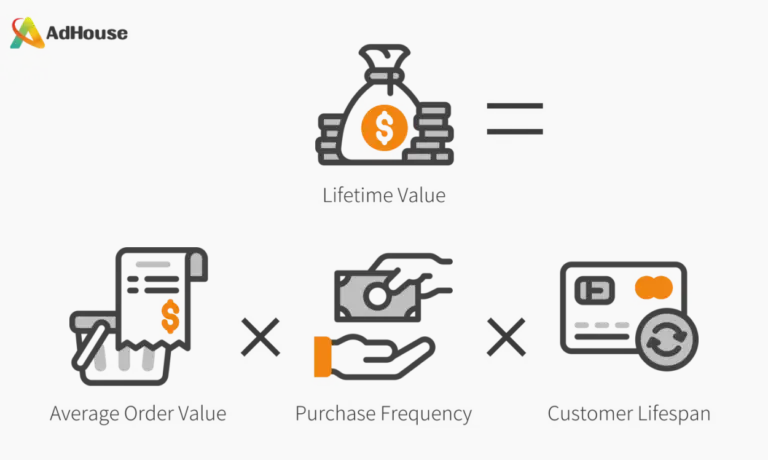

What is Lifetime Value (LTV)?

Lifetime Value (LTV) measures the total revenue a business can expect from a customer over the entirety of their relationship.

Why is it Important to Know Lifetime Value (LTV)?

LTV is essential for understanding the long-term value of your customers. It helps determine how much you can spend on acquiring and retaining customers, emphasizing the importance of customer loyalty.

LTV Formula:

LTV Calculation Example:

If a customer spends $50 per purchase, buys 4 times a year, and remains a customer for 3 years, their LTV is $600 ($50*4*3=$600).

Give Your Business a Marketing Boost with Adhouse Digital Advertising

Cost Per Acquisition (CPA)

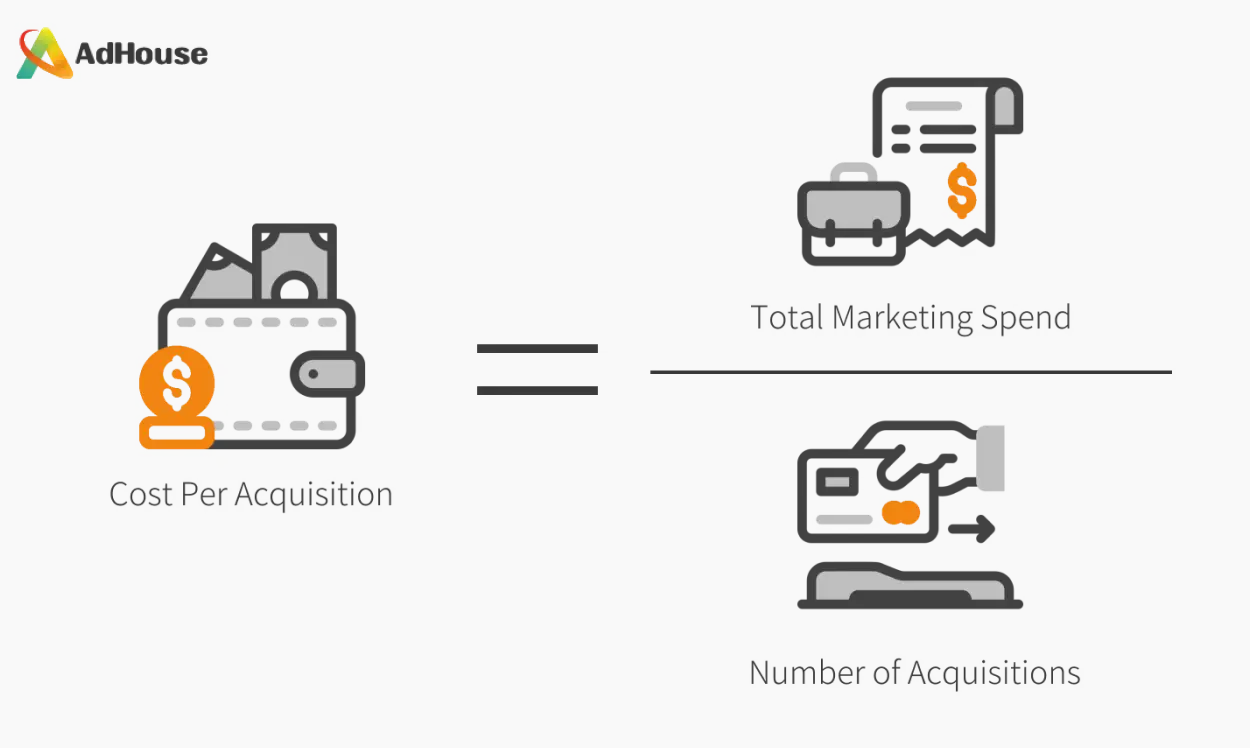

What is Cost per Acquisition (CPA)?

Cost Per Acquisition (CPA) is the average cost to acquire a single paying customer.

Why is it Important to Calculate Your Cost Per Acquisition (CPA)?

CPA reveals the efficiency of your advertising efforts. Lowering your CPA means acquiring more customers for less money, increasing your profit margins.

CPA Formula:

CPA Calculation Example:

If you spend $2,000 on a marketing campaign that acquires 50 new customers, your CPA is $40 ($2000/50=$40).

Customer Acquisition Cost (CAC)

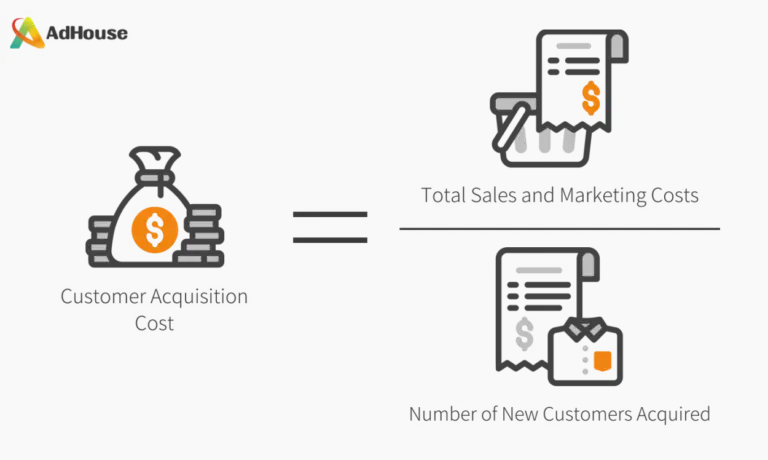

What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) encompasses all expenses related to acquiring a new customer, including marketing and sales costs.

Why is it important to know your customer acquisition cost (CAC)?

CAC helps you evaluate the cost-effectiveness of your customer acquisition strategies and your overall marketing strategy. Comparing CAC with LTV provides a clear picture of your customer base’s profitability.

Cost of Acquisition (CAC) Formula:

One interesting angle to this metric is that it includes everything you spend on marketing, including such expenses as the marketing agency’s fees. CPA will only show the cost to acquire a client from paid channels, while CAC will show your total cost to acquire a client.

Cost of Acquisition (CAC) Calculation Example:

If your total sales and marketing costs are $5,000 and you acquire 100 new customers, your CAC is $50 ($5000 / 100 = $50).

Conclusion

Understanding and optimizing these four key metrics—AOV, LTV, CPA, and CAC—are crucial for successful e-commerce and digital marketing. These metrics provide essential insights into your business performance and guide you in making data-driven decisions. By mastering these fundamentals, you can maximize your marketing efforts, enhance your profitability, and drive sustainable growth for your e-commerce business.

Frequently Asked Questions

Typical metrics in unit economics analysis include Average Order Value (AOV), Lifetime Value (LTV), Cost Per Acquisition (CPA), Customer Acquisition Cost (CAC), gross profit, gross margin, contribution margin, and churn rate. These metrics help businesses understand their direct costs, variable costs, and overall profitability.

A higher AOV means that each customer is generating more revenue, which can improve the business’s gross margin and overall profitability. Increasing AOV can lead to more net profit without needing to increase the number of customers.

Lifetime Value (LTV), or customer lifetime value (сLTV), measures the total revenue a business can expect from a customer over their average customer lifetime. It is crucial because it helps businesses understand the long-term value of a customer, guiding decisions on how much to invest in acquiring and retaining customers.

A high LTV indicates strong customer loyalty and a higher net profit over time.

If CPA is too high compared to the Lifetime Value (LTV), the business might struggle to be profitable. Reducing CPA can improve the contribution margin and overall bottom line.

Customer Acquisition Cost (CAC) includes all expenses related to acquiring a new customer, including marketing and sales costs. CAC differs from CPA in that CPA typically only includes paid marketing expenses.

CAC provides a more comprehensive view of the costs of gaining new customers. Comparing CAC with LTV helps evaluate the profitability of customer acquisition strategies.

Knowing the AOV, LTV, CPA, and CAC allows businesses to allocate their marketing expenses more efficiently, ensuring they do not spend more than a customer is worth. This helps maximize the sum of all income.

Higher customer retention rates mean customers stay longer and spend more over time, increasing annual revenue and net profit. Retaining customers is often more cost-effective than acquiring new ones, reducing the CAC and improving the bottom line.

By understanding gross profit, contribution margin, and direct costs, businesses can set prices that maximize net profit. Adjusting prices based on unit economics equation ensures that the business remains competitive while covering production costs and generating a healthy gross margin.

Several tools and software can help in calculating and tracking unit economics, including financial modeling software, CRM systems, and analytics platforms.

Tools like Salesforce, HubSpot, and specialized saas business platforms offer comprehensive features for tracking customer lifetime, monthly basis revenue, marketing expenses, and more. Additionally, accounting software like QuickBooks can help manage direct costs and production costs.

To improve unit economics for better business performance, focus on increasing AOV through upselling and cross-selling, enhancing LTV by improving customer retention rate and loyalty programs, reducing CPA through optimized marketing campaigns, and lowering CAC by improving sales efficiency.

Regularly reviewing and adjusting your business strategy based on unit economics insights is key.

A business should review its unit economics on a regular basis, ideally on a monthly basis. Frequent reviews help in quickly identifying any issues and making necessary adjustments to improve profitability and efficiency. Tracking these metrics over different periods of time ensures that the business remains agile and responsive to market changes.

Yes, unit economics can vary significantly by industry or business model. For example, saas companies may have different unit economics compared to retail or manufacturing businesses due to variations in production costs, customer support needs, and customer lifetime. Each business model has unique factors that impact its unit economics.

Strong unit economics with a positive gross margin and high LTV ensure a steady inflow of cash, contributing to healthy cash flow. Conversely, weak unit economics can lead to cash flow problems, as the costs to acquire and retain customers may exceed the revenue they generate.

Regularly monitoring unit economics helps in maintaining a positive cash flow and ensuring long-term business sustainability.